Why Dividend Growth?

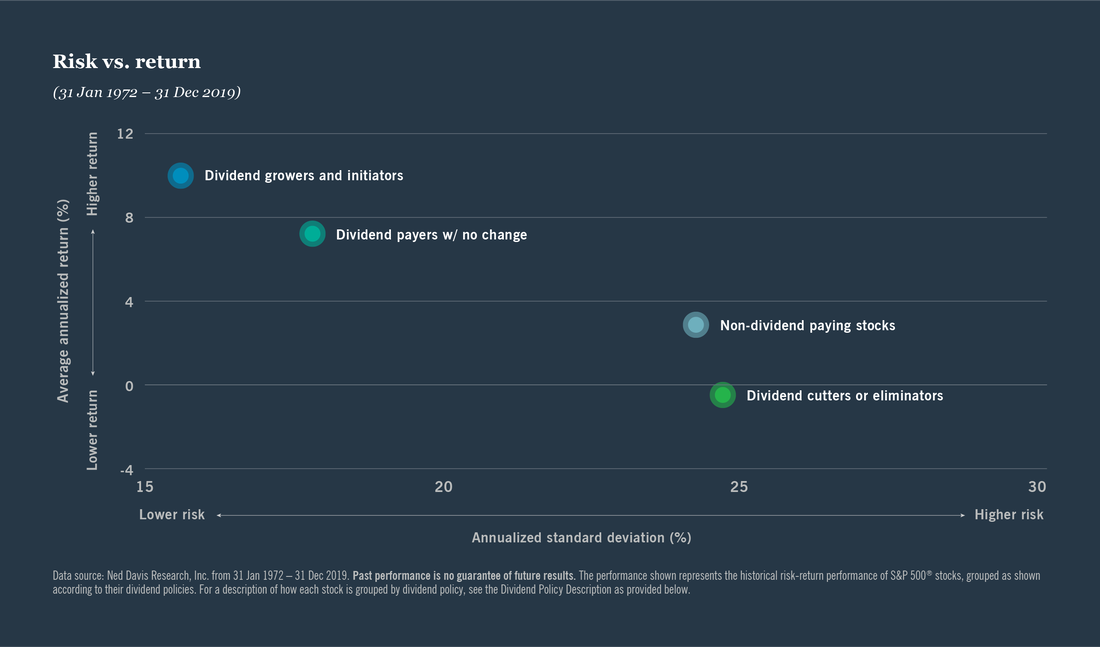

- Dividend-paying stocks present a compelling risk-adjusted return option for investors who can accommodate higher short-term volatility than fixed income to gain additional yield and capital appreciation.

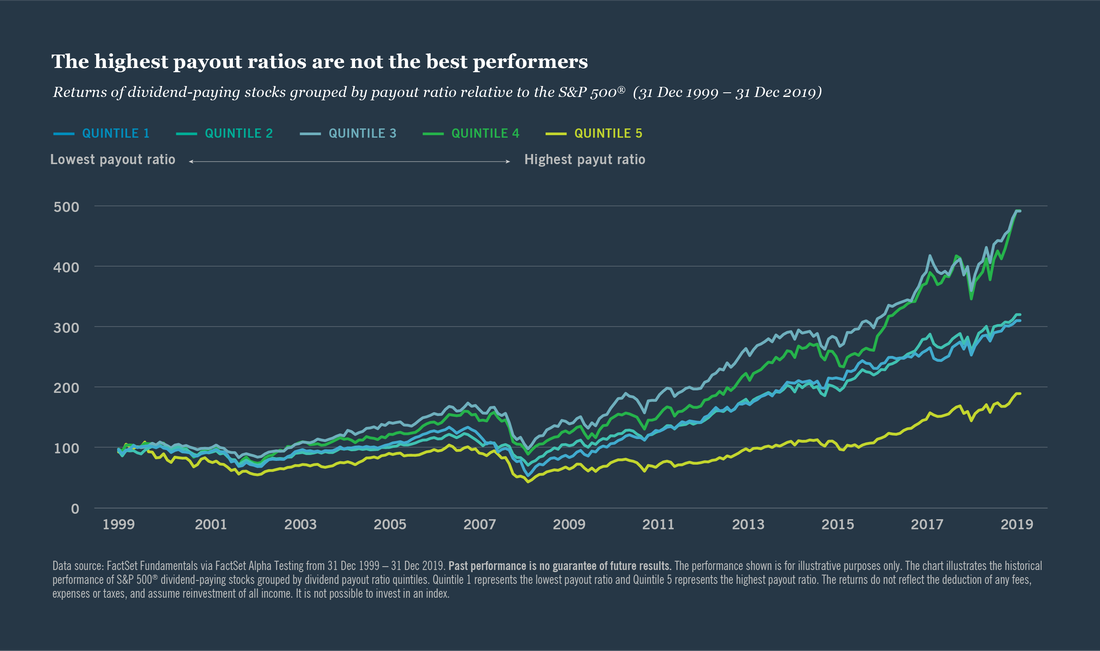

- Income DIY investors can learn to maintain dividend growth and sector diversification by reviewing and rebalancing positions every year. By doing so, investors will achieve better long-term performance assured by income growth every year.

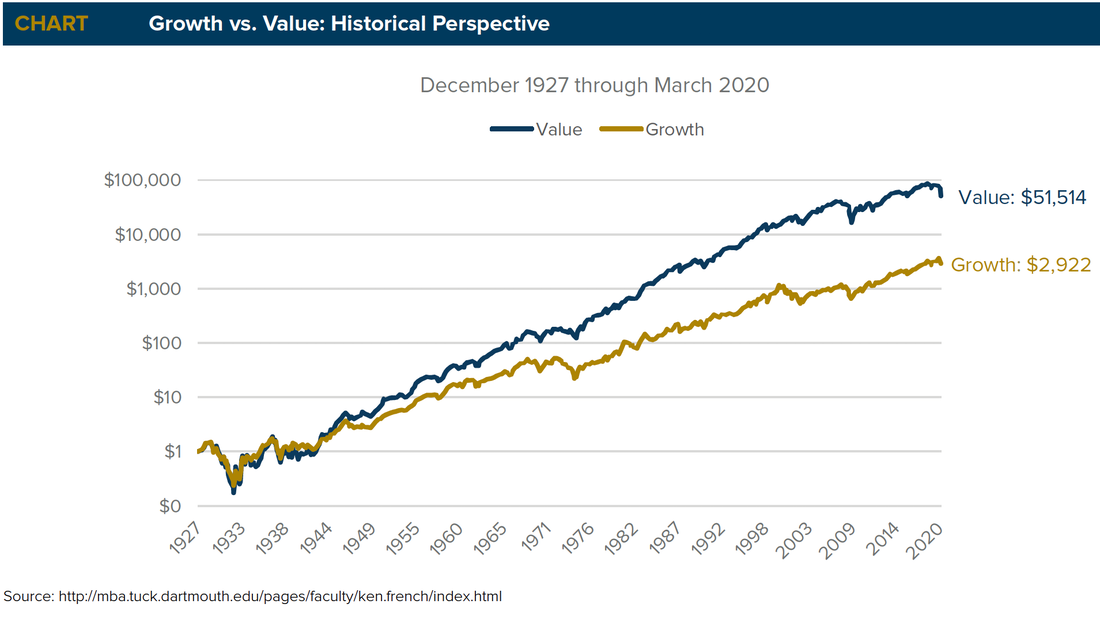

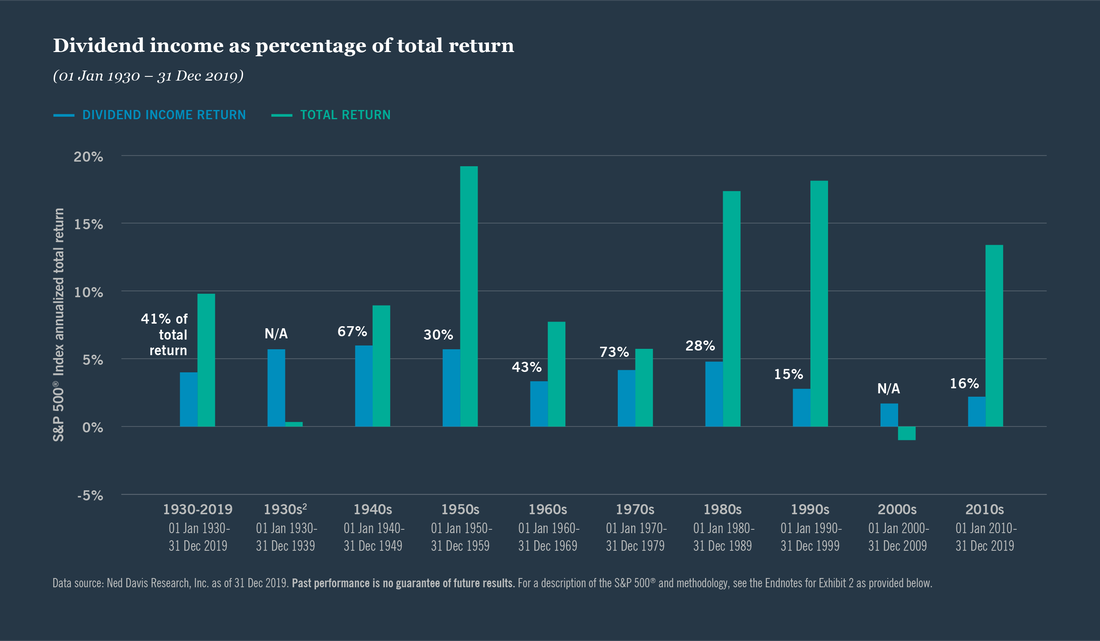

The U.S. equity market has classified dividend stocks with reasonable yields as value stocks. The growth of dividends every year will benefit income DIY investors with long-term capital appreciation and positive return certainty. Many investors may argue that growth stocks have performed better in recent years. Keep in mind that historical performance has shown that value has outperformed growth in the long run.

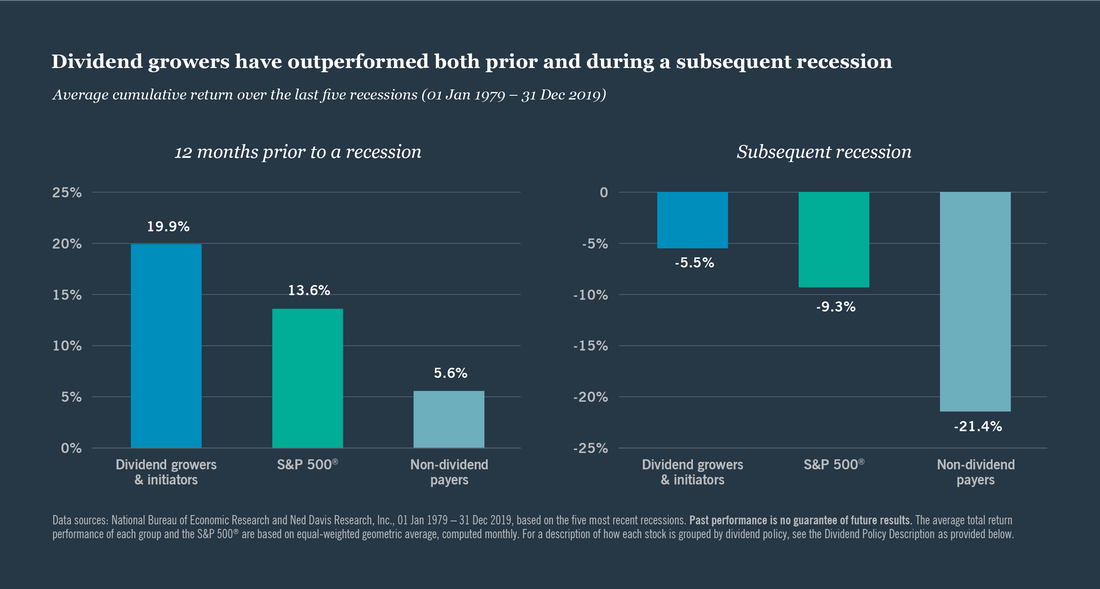

Consider that equity dividend income generally grows alongside corporate earnings. Such dividend growth becomes even more attractive if inflation surfaces and erodes the fixed income’s purchasing power. Over the long-term, dividend growth stocks have historically offered both income growth and capital appreciation. Here are four charts that further show why dividend growth is an excellent strategy for income DIY investors. (source: Nuveen, LLC)